Tax time made easy!

Tax time made easy!

It’s that time of year again, and while we are feeling the cool snap, somewhere in Canberra, the ATO is quietly warming up 🔥 its audit engines, especially for crypto users.

Think data-matching, cross-referencing, and paying more attention than ever before 👀.

A reminder from our CEO Blake Cassidy: "It is important for Australians to record both their crypto gains and losses due to the ATO treating cryptocurrency as property for capital gains tax purposes.”

In the meantime…

🧾 Here's what you need to know (basic nuts and bolts of crypto):

-

Every trade, sale, or swap counts even if you moved your crypto between wallets or swapped coins. It's all part of your capital gains equation. Monitor it and be on top of it.

-

Earning rewards, interest or staking returns? That’s income. And income = taxable. (Sorry. We don’t make the rules. We just help you follow them.)

-

Lost your keys or sent ETH to a black hole? You might be able to claim it as a capital loss but you’ll need proper documentation (a crying emoji doesn’t count).

Plus, if you’ve been using Bamboo this last financial year, it’s important to understand how your crypto activity might factor into your return.

Whether you’ve made a withdrawal, a top-up, or just let your round-ups do their thing, the ATO has a few rules around digital assets, and we’re here to help you stay on the right side of them.

Inside this update:

- Bonus tax podcast with Crypto Tax Calculator's Shane Brunette

- How to access your Bamboo transaction history

- Tools (and tips) to help make reporting easier, including the introduction of the Crypto Tax Calculator

Let’s take the stress out of crypto tax and keep things simple, just the way Bamboo was built to be 🌱.

*****

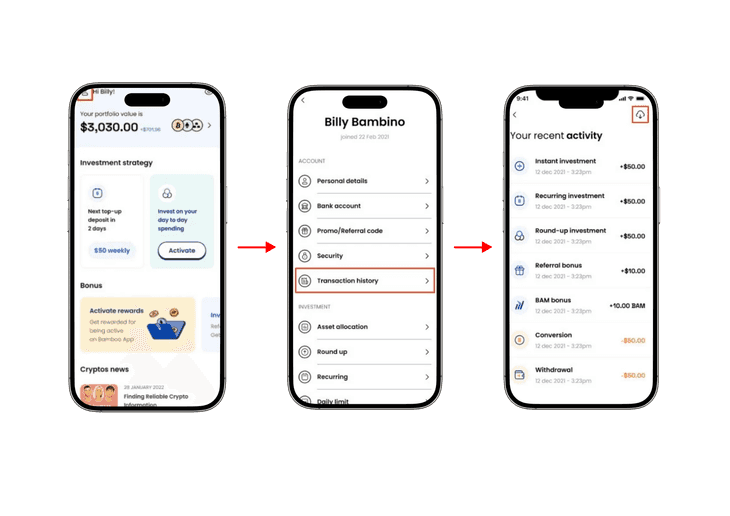

Accessing & exporting your reports 👇🏼

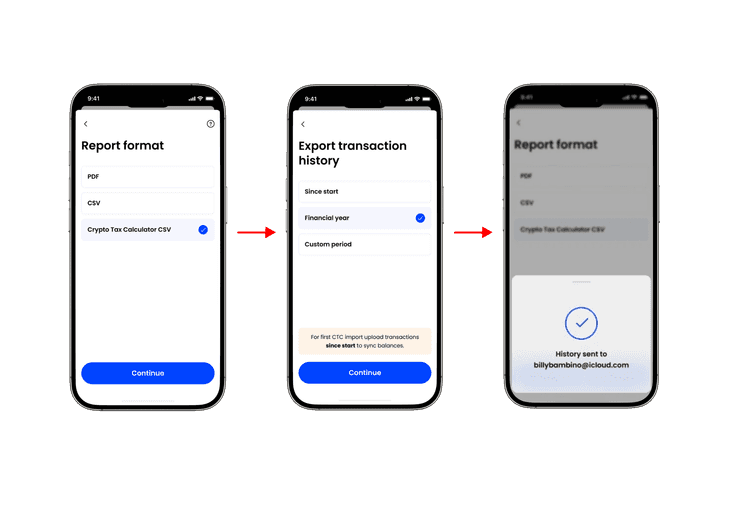

Whether you're an individual user or an SMSF investor, we provide flexible options for accessing and exporting your tax reports. Here are the available export formats:

PDF – A detailed PDF spreadsheet view of your transactions and summaries.

CSV – A detailed CSV spreadsheet view of your transactions and summaries.

NEW: Crypto Tax Calculator CSV – Just download the pre-formatted file in-app and upload it into CTC to add your transactions in CTC and generate your tax reports.

*Bamboo is an official partner of Crypto Tax Calculator (CTC), which is an Australian-made crypto tax software solution for all types of crypto users. Crypto Tax Calculator is an ideal platform to streamline your tax preparation.*

Note: First time sending your Bamboo data to Crypto Tax Calculator? Upload your entire transaction history, so CTC will calculate cost basis and gains accurately; after that you can upload by date range.

Bonus: Save 25 % on your first year – enter the promo code BAMBOO at any plan checkout on the Crypto Tax Calculator website.

*****

For SMSF users👇🏼

If you manage a Self-Managed Super Fund (SMSF), you’ll need to prepare specific reports for tax purposes at the end of each financial year.

Guide for SMSF account owners:

Export your transaction report

First-time export: select “Since start” so Crypto Tax Calculator receives your full transaction history and can establish an accurate cost base.

Later exports: choose the specific financial year you need.

Use Crypto Tax Calculator (CTC)

Upload the CTC CSV file directly into the software.

It will automatically categorize transactions, and you can then generate your tax reports.

Consult your tax advisor to ensure compliance with current taxation laws. The information provided does not take into account individual taxpayers' circumstances, and we are unable to provide tax advice.

Need Help?

If you’re working with an accountant, simply send them the exported file.

*****

How to export your Bamboo transaction history into Crypto Tax Calculator 👇🏼

Open the Bamboo app and, on the Home screen, tap the Settings button (person icon in the top-left corner).

Select Transaction history from the Settings screen.

On the Activity screen, tap the Export button (cloud-download icon) in the top-right corner.

Select Crypto Tax Calculator CSV as the report format and tap Continue.

Choose a date range for your report:

Since start — downloads all data since you’ve started using the app. Note: First time using CTC? Export all transactions since start so your balances line up.

Financial year — choose the financial year you want to download the transactions for.

Custom period — set your own start and end dates of the report.

A confirmation message appears — your CSV is emailed to the address linked to your Bamboo account

Download the file from your email, then upload it into Crypto Tax Calculator to complete your import.

Tip: If the email doesn’t arrive within a few minutes, check your spam folder or confirm your email address in Settings → Personal details. For additional help, go to Profile → Help & Support in the Bamboo app

*****

All of these instructions are also on our website under Frequently Asked Questions.

And remember, if you’re staring at your tax return thinking “surely my $50.00 in Bitcoin round-ups doesn’t really matter,” well, the ATO thinks it might. So let’s not give them a reason to audit your oat milk purchases & Netflix subscription. 😬

Team Bamboo 🌱

Crypto Jargon – The Phrases You Hear but Don’t Understand Explained!

How to Find Reliable Crypto Information

5 companies that changed their mind about Bitcoin.

The latest crypto news delivered straight to your inbox.

Subscribe to our newsletter